For many individuals struggling with overwhelming debt, bankruptcy can be an attractive option that allows the individual to start over with a “blank slate,” as it were. However, not all debts can be discharged through bankruptcy, and some are easier to discharge than others.

While it is possible to discharge income tax debts through bankruptcy, it is significantly more difficult to do so than for other types of debts, such as consumer credit card debt.

Types of Bankruptcy

The first thing to understand is the basics of the various forms of bankruptcy.

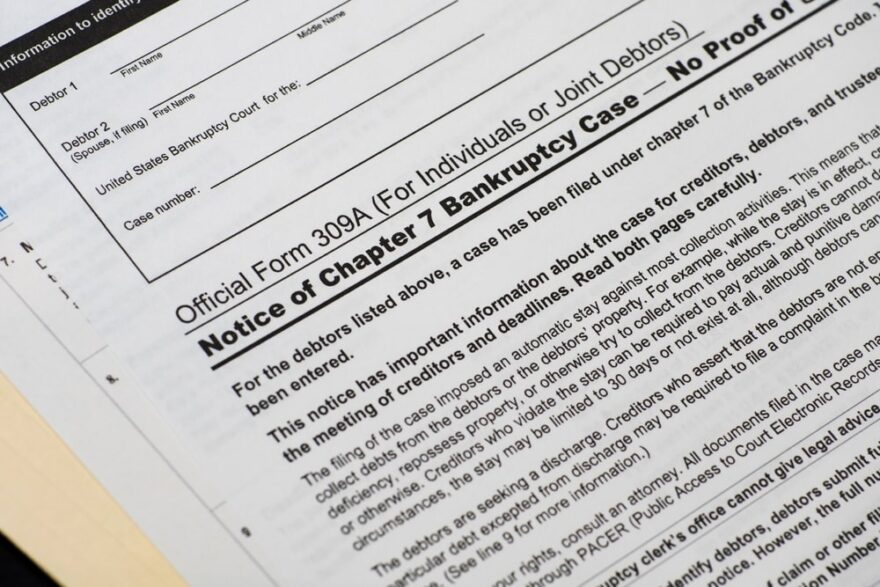

Chapter 7 bankruptcy provides for a discharge of all of the debtor’s allowable debts by authorizing the bankruptcy court to take control of the debtor’s nonexempt assets and liquidate them in order to pay off as much of the debt as possible. If there are not enough assets left over to cover all debts, the remaining unpaid balances are discharged.

Chapter 13 bankruptcy allows the debtor to reorganize his or her debts and pay them off over time; usually lasting no longer than 60 months, but may only discharge some of the debt.

Chapter 11 is another type of bankruptcy that is used for reorganizing business debts, although some individuals do use Chapter 11 to reorganize their personal debts as well. Similar to Chapter 13, it allows the filer to discharge certain debts, and then reorganizes the remaining debts into a repayment plan.

Requirements for Discharging a Tax Debt

So long as a debtor meets all of the following requirements, their income tax debt can be discharged through Chapter 7 bankruptcy:

- The due date for filing the tax return in question was at least three years prior to the bankruptcy declaration

- The tax return was filed at least two years before filing for bankruptcy (generally applicable to late filed returns. In some bankruptcy jurisdictions taxes due on a late filed return won’t qualify for discharge.

- The debtor is eligible under the 240-day rule (i.e., the IRS must have assessed the tax debt at least 240 days before the debtor filed for bankruptcy. This rule generally arises if you’ve filed an amended tax return or were subject to an IRS audit.

- The debtor did not commit willful tax evasion

- The debtor did not commit tax fraud

For any tax debts that are not dischargeable in bankruptcy, relief in the form of installment agreements and an offer in compromise remain available. Our Boca Raton tax debt relief experts can find the right solution for you.

Prior Tax Lien Filed

If the IRS has filed a Notice of Federal Tax lien prior to the debtor filing for bankruptcy, the lien attaches to pre-bankruptcy property in which the debtor had equity. So, although a bankruptcy may wipe out your personal obligation to pay the tax debt, and prohibit the IRS from levying your bank account or garnishing your wages, the lien remains on the property. This means if you want to sell the property, you’ll have to pay off the tax lien.

Learn More About Boca Raton Tax Debt Relief

We know that bankruptcy can be an intimidating prospect for many people, especially when tax debts are involved. That’s why we’ll work with your bankruptcy attorney to resolve your back tax problems. For more information about the possibility of discharging tax debt through bankruptcy, contact the Boca Raton tax debt relief advisors at East Coast Tax Consulting Group by calling 866-550-7655.