As U.S. businesses continue to recover from COVID-19’s economic devastation, the U.S. Small Business Administration (SBA) is expanding COVID-19 EIDL loans opportunities.

Read More

If you are the owner of a small business that was able to obtain a Paycheck Projection Program (PPP) Loan, you have probably already started worrying about how you are…

Read More

Every year, the majority of taxpayers file their returns with the IRS between by the April due date. However, the IRS does not just take taxpayers’ word regarding the information…

Read More

If you’re thinking of selling real property that will result in a gain, there are a number of issues that impact the amount of taxes you will owe, and you…

Read More

Individuals as well as corporations, partnerships, and trusts that have financial interests in or authority over one or more foreign financial accounts need to report these relationships to the U.S.…

Read More

The recent tax law changes eliminated the deduction for personal casualty losses for tax years 2018 through 2025, but did retain a deduction for losses within a federally declared disaster…

Read More

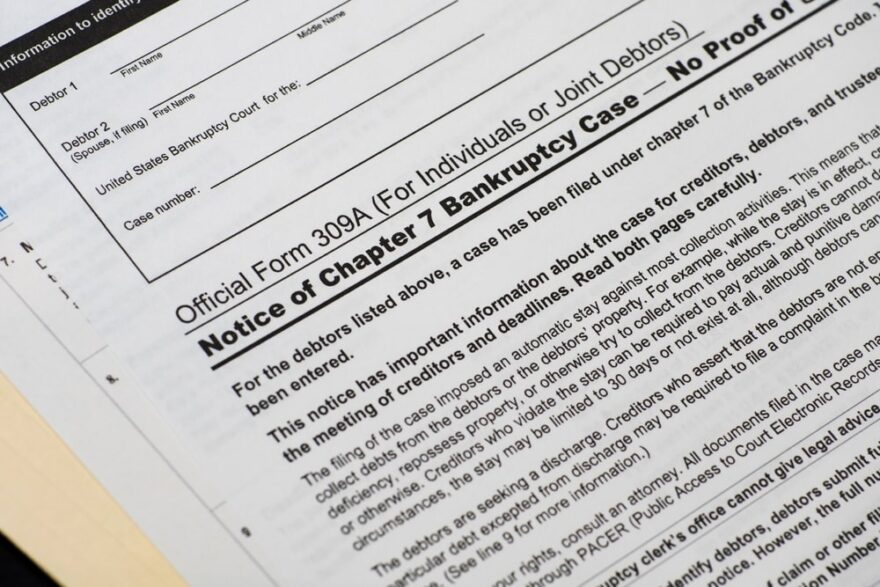

For many individuals struggling with overwhelming debt, bankruptcy can be an attractive option that allows the individual to start over with a “blank slate,” as it were. However, not all…

Read More

If you are a business owner who is accustomed to treating clients to sporting events, golf getaways, concerts and the like, you were no doubt disappointed by the part of the…

Read More

As a result of an accident a Plantation resident received a significant personal injury settlement and asked one of our tax consultants whether it is taxable.

Read More

Do you know that if you receive a gift or bequest from a family member, friend or estate who is considered a foreign person you may have a reporting requirement…

Read More