Some days, it seems like you can’t listen to the radio, watch television, or use the internet without coming across an advertisement for a company that promises to settle your tax debt for next to nothing. These ads are usually talking about an Offer in Compromise, an IRS program that allows some taxpayers to negotiate a settlement for less than what they owe in back taxes. Here’s what those ads fail to mention: not every taxpayer with tax debt is eligible for an IRS Offer in Compromise.

An Offer in Compromise can be extremely helpful in resolving your back taxes. However, a thorough analysis must be performed to determine whether or not you are a good candidate for the program. It’s also important to consider if another tax resolution method is a better fit for your situation. At East Coast Tax Consulting Group, we always recommend the best resolution strategy for your situation. After a thorough analysis of your tax debt and other financial factors, we can decide if an Offer in Compromise is right for you.

Determining IRS Offer in Compromise Eligibility

For the IRS to approve your offer, you must propose a reasonable compromise. The amount you offer depends on:

- The equity in your assets,

- Your excess monthly income (after allowable expenses), and

- The time period over which you’ll pay your offer.

Generally, the IRS values your property at quick sale value, minus any debt you have on the property. The quick sale value is usually about 80% of a property’s value. The IRS also provides allowable expenses in multiple categories based on national and local standards. Your Offer in Compromise eligibility partially depends on your excess monthly income after these expenses:

- Food, Clothing, and Other Items

- Housing and Utilities

- Car Expense: Ownership

- Car Expense: Operating

- Out-of-Pocket Health Care Expenses

You are allowed the full IRS standard for food, clothing, and other items as well as out-of-pocket health care expenses, even if you spend less. All other allowable expenses must be documented and are limited to the IRS standard except under special circumstances. Some other expenses—such as medical insurance, court-ordered payments, federal, state, and local income taxes, and FICA taxes—are generally allowable without limitations.

There are two payment duration options. You can pay your offer in five or fewer installments within five months of acceptance with a lump sum cash offer. This requires you to make a 20% nonrefundable payment with your offer. You can also use a periodic offer, which means paying within 24 months of submitting your offer. In determining the amount of excess income to be included in your offer, a multiple of 12 is used in a lump sum cash offer, while a multiple of 24 is used in the periodic offer.

Normally, the IRS will not accept an offer if the taxpayer is able to fully pay the debt within the remaining statute of limitations for collections.

Offer in Compromise Examples

These examples should give you a better understanding of how an offer amount is calculated and whether you may eligible for an Offer in Compromise.

Example 1: A Wantagh Family of Four

Taxpayer A and his wife owe three years of back taxes totaling $90,000. The remaining statute of limitations on collections is four years.

The couple owns a home in Wantagh, NY where they live with their two young children. The home is worth $400,000 and has a mortgage of $325,000. Taxpayer A is employed and earns $120,000 a year. His wife does not work, as she takes care of their children. For offer purposes, the taxpayers do not have any equity in their home as the quick sale value of $320,000 ($400,000 x 80%) is less than the mortgage of $325,000.

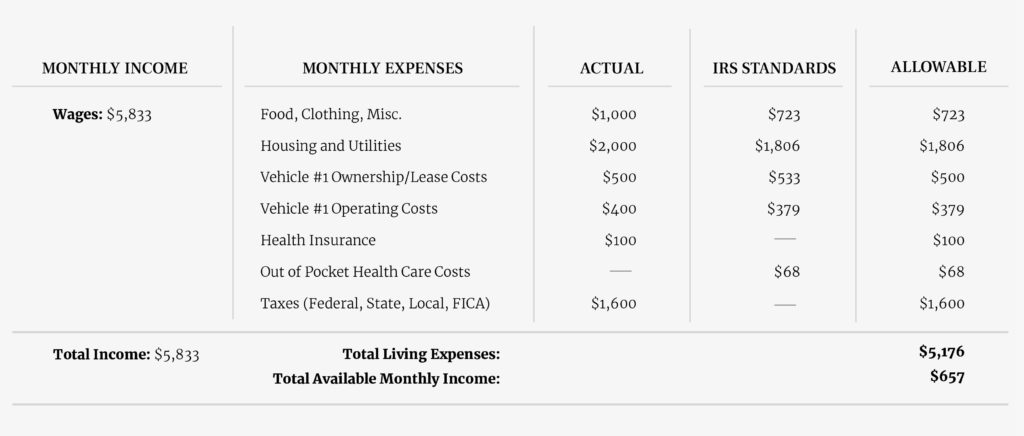

The family’s actual monthly expenses are as follows:

- Food, Clothing, and Other Items: $1,900

- Housing and Utilities: $3,400

- Car Expense: Ownership

- Taxpayer A’s Car Lease: $525

- Wife’s Car Lease: $300

- Car Expense: Operating

- Taxpayer A: $400

- Wife: $300

- Health Insurance: $550

- Term Life Insurance: $50

- Charitable Contributions: $50

- Income and FICA Taxes: $2,000

- Other: $525

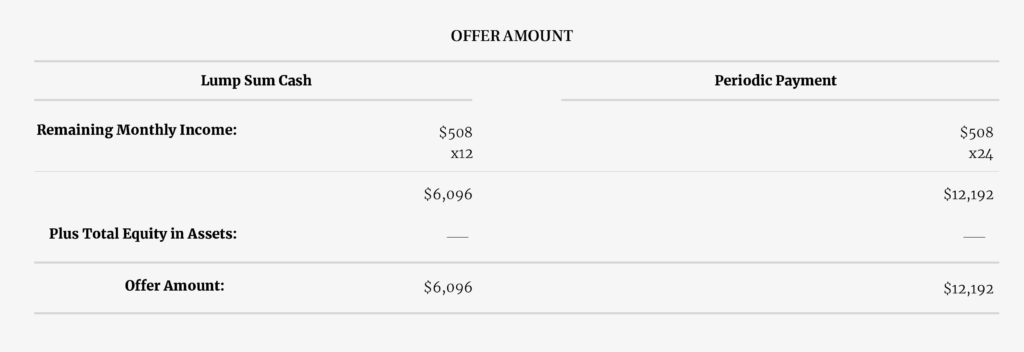

The offer amount is calculated below:

Remember, this taxpayer owes back taxes totaling $90,000. The lump sum offer of $6,096 and periodic payment offer of $12,192 represent potential tax savings of approximately $83,900 and $77,800, respectively. You can see that charitable contributions and other personal expenses incurred by the taxpayers are not allowed in computing the offer amount, thereby increasing the required payment. The family in this example can borrow the money needed to fund their offer and thus are good candidates to resolve their IRS back taxes with an Offer in Compromise.

Example 2: A Renter in Ft. Lauderdale

Taxpayer B is single and lives in Ft. Lauderdale, FL, where he rents a condo on the Intracoastal. He owes the IRS $30,000 in back taxes and the remaining statute of limitations on collections is six years. Taxpayer B earns $70,000 a year and has no assets other than his personal belongings.

His monthly living expenses are as follows:

- Food, Clothing, and Other Items: $1,000

- Housing and Utilities: $2,000

- Car Expense: Ownership: $500 (Lease)

- Car Expense: Operating: $400

- Health Insurance: $100

- Income and FICA Taxes: $1,600

- Other: $400

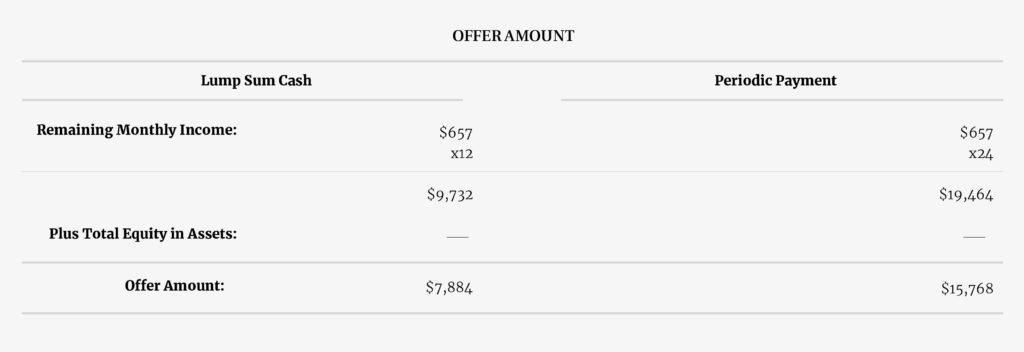

The offer amount is calculated below:

With $30,000 in total tax debt, the lump sum offer of $ 7,884 and periodic payment offer of $ 15,768 represent potential tax savings of approximately $22, 100 and $14,200 respectively. The taxpayer in this example is also able to borrow the money needed to fund his offer. At first, this looks like another example of IRS Offer in Compromise eligibility.

However, the taxpayer’s excess monthly income is sufficient to fully pay his outstanding taxes over the remaining statute of limitations, including any additional interest and penalties. Therefore, the IRS will not accept his offer and instead require the taxpayer to enter into an installment agreement.

Is an Offer in Compromise Right for You?

An Offer in Compromise can help struggling taxpayers resolve their IRS tax problems. An extensive analysis of each taxpayer’s situation must be performed to determine if it is the right resolution. Contact East Coast Tax Consulting Group to learn more about Offer in Compromise eligibility.