Resolving your back taxes in a way that works for you and your family, as well as satisfying the IRS, is a great feeling. We recently helped Carl become an Offer in Compromise success story by using the IRS allowable living expenses to his advantage. He was able to submit a successful Offer to the IRS and stop worrying about his tax debt!

Could this Offer in Compromise strategy work for you? Here’s how Carl resolved his tax debt by using allowable expenses to his advantage:

The Background

Carl is a single, employed 55-year-old living in Broward County. He did not pay any of the taxes he owed to the IRS between 2015 and 2018, when he was self-employed. Now, he owes $25,000 in back taxes.

He contacted East Coast Tax Consulting Group for help resolving this tax debt. Our first step was obtaining his tax transcripts from the IRS. Carl also completed our online client questionnaire. The transcripts, along with Carl’s answers to our questionnaire, allowed us to fully understand Carl’s situation and confirm that the IRS had the correct information about Carl’s back taxes.

Taking the time to fully understand the situation gave our tax professionals a better idea of what tax resolution strategies Carl might be eligible for, including an Offer in Compromise.

Calculating IRS Allowable Expenses

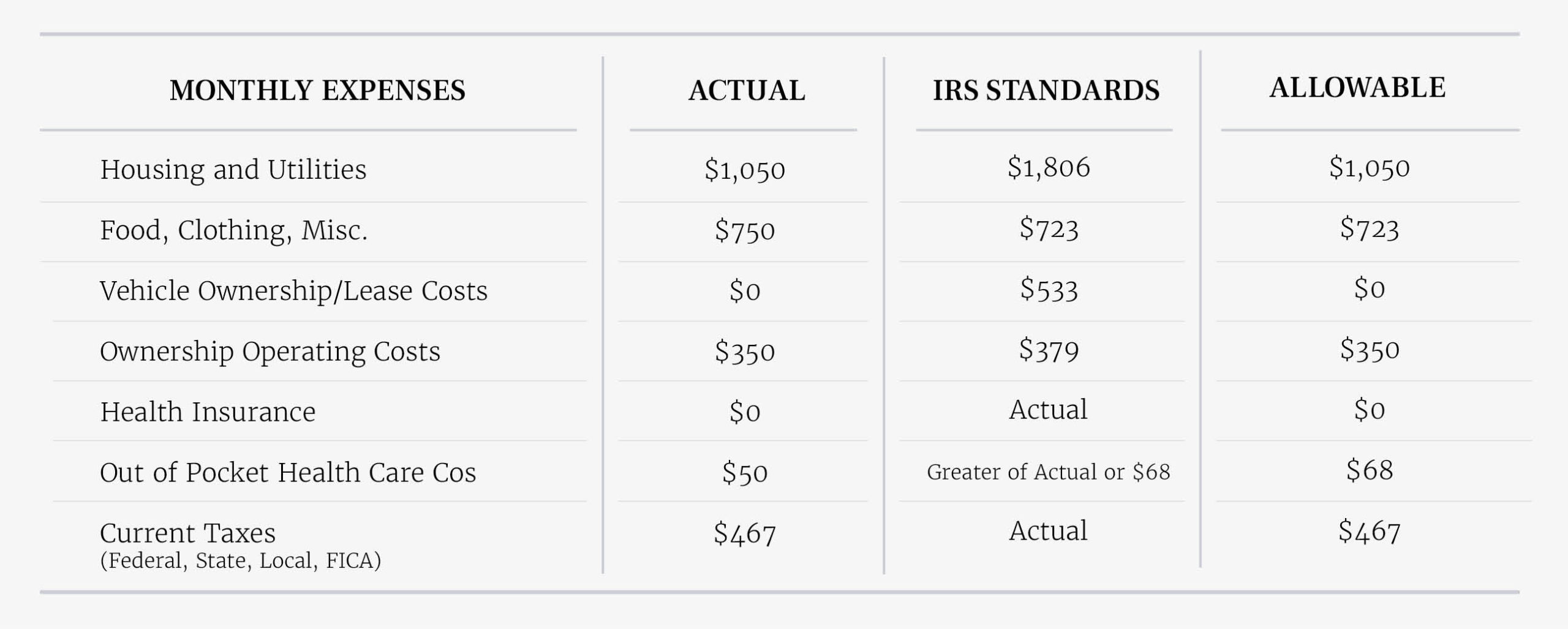

Carl’s only asset is a seven-year-old car with more than 85,000 miles on it and in need of repairs. His annual salary is approximately $40,000 which makes his monthly income about $3,333. In order to assess whether an Offer in Compromise might be right for Carl, we looked at his actual living expenses compared to the IRS allowable expenses.

Monthly income:

Wages: $3,333

Total allowable living expenses: $2,658

Total available monthly income: $675

The remaining collection statute on Carl’s back taxes is 8 years, or 96 months. If he uses his total available monthly income of $675, he can pay his tax debt in its entirety before the statute expires. This means he is not eligible for an Offer in Compromise.

Sometimes, it’s more important to look at what a taxpayer isn’t spending, rather than what they are spending, when it comes to allowable expenses. We look beyond a taxpayer’s current expenses to determine what allowable expenses they are not incurring but might be helpful in their daily life. This strategy can help lower an individual’s total available monthly income and therefore get an Offer accepted.

The Resolution

In Carl’s case, we recommended he lease a new car (which he needed) with a payment up to the IRS allowable amount of $533. This would reduce his available monthly income to $142, which would be insufficient to pay his tax debt in full over 96 months. Carl decided on a monthly lease payment of $500, leaving him with $175 in total available monthly income after allowable living expenses.

This puts his reasonable collection potential (and Offer amount) at $2,100, which is $175 multiplied by 12 months. The available monthly income was multiplied by 12 because Carl submitted a lump sum offer, which requires no more than five payments within five months of the IRS accepting the Offer as well as a 20% down payment. Carl got help from a family member to take advantage of the benefits of a lump sum offer.

Carl was able to pay $2,100 to settle a $25,000 tax debt, which would have continued to accrue interest and penalties until paid in full! This specific Offer in Compromise tactic may not work for you. However, there are other ways to strategically plan for an Offer the IRS is likely to accept based on your reasonable collection potential. Our team of tax professionals can review your unique situation during a free consultation. Schedule one today!